The global MFA market was valued at about USD 16.31 billion in 2023 and is projected to grow to USD 41.29 billion by 2030, representing a CAGR of ~14.2% from 2023 to 2030.

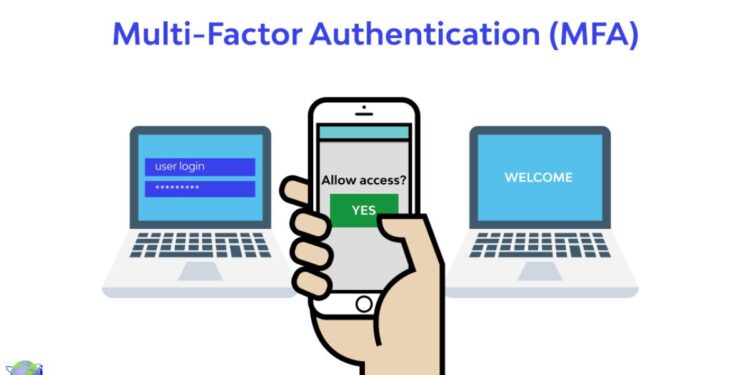

Digital banking is still transforming the customer-bank interaction trend. Mobile banking applications are now used to check balances, as well as execute transactions worth billions of dollars, and are therefore an obvious target of cybercriminals. Banks should implement more robust security systems as fraud like stealing credentials, phishing, and account hijacking, are increasing. One of the most efficient security measures against unauthorized access in banking applications has become Multi-Factor Authentication (MFA).

In the case of any app development company in UK that has to work with financial institutions, the usage of MFA has ceased to be an option, but rather a requirement in terms of trust, compliance, and scalability.

Why MFA Is Critical for Banking Apps

The conventional muster techniques of authentication which are based only on usernames and passwords are no longer sufficient. Weak passwords, reused credentials and social engineering are common weaknesses that the attackers exploit. MFA solves these vulnerabilities by imposing on the user to validate their identity with two or more independent factors.

These aspects are normally categorized into three:

- Something that is in possession of the user (Password or PIN)

- Something the user possesses (mobile device, hardware token or OTP)

- What the user is (biometric identifiers like fingerprint or facial recognition)

Multiple factors used together increase the chances of unauthorized access in banks to a minimum, so in case one of the credentials is compromised, all the chances of unauthorized access are minimized.

MFA Advantages in Banking Applications

Increased Protection against Fraud

MFA helps to significantly reduce the threat of account takeovers and unauthorized transactions. Only with the second or third factor, the attackers cannot pass the extra verification layers, even with the received login credentials.

Regulatory Compliance

The world financial policies are driving towards fierce customer authentication. Regional banking standards like PSD2, GDPR and other regulations mandate banks to use layered security controls. MFA assists the institutions to comply with these compliance requirements without the risk of incurring regulatory penalties.

Increased Customer Trust

Customers would require banks that would secure their bank accounts. When biometric logicity, OTP auth, or device authentication is displayed to the customers, they feel that the app is more secure. This confidence is a direct influence on the retention and brand reputation.

Reduced Operational Costs

Though the implementation of MFA demands an initial implementation cost, it decreases the total costs in the long run since it will decrease the number of fraud related losses, customer support tickets, and account recovery processes.

“In digital banking, security is no longer a feature, it is the foundation. Multi-factor authentication ensures trust is built into every transaction.”

– Roshaan Faisal, Business Development Head at 8ration

The MFA Techniques in use in Banking Apps

One-Time Passwords (OTPs)

OTPs are frequently received in the form of SMS, email, or authenticator applications by banks. Although the SMS-based OTPs are still in use, there has been a shift to app-based or push-based OTPs with a greater level of security being favored by many institutions.

Biometric Authentication

Voice authentication, facial recognition and fingerprint scanning offer an ease of use. Biometrics are very secure because they are convenient, and are therefore suitable when one uses their banking applications frequently.

Push Notifications

Push-based authentication is the process of sending an approval request to the registered device of the user. This approach helps minimize friction and increase the level of security since authentication is linked to a trusted device.

Hardware and Software Tokens

Users of high-net-worth and corporate banking will usually use physical or software tokens that produce time-based codes to allow them to be authenticated.

Best Practices of Introducing MFA into Banking Apps

User Experience and Balance Security

The banks should not cause any kind of friction that will irritate the users. Adaptive MFA is beneficial because it only activates further verification when a high-risk action happens, including making a large transfer or a new device login.

Authenticate Risk-basedly

The current banking applications consider situational attributes like device type, location, log-in activity and transactional history. In case the system recognizes abnormal operation, it imposes stricter authentication without the need of human intervention.

Secure MFA Data Storage

Banks have to encrypt biometric identifiers, OTPs, and authentication tokens both in transit and storage. Key management and adherence to privacy laws is critical.

Offer Backup Authentication

The users can lose access to their devices. Banking apps must have secure recovery options, e.g., verified email recovery or reauthentication with the help of customer support.

Regularly Test and Update MFA Systems

Threats evolve rapidly. The banks need to audit the workflows of MFA regularly, perform penetration tests, and enhance authentication to respond to emerging attack vectors.

Challenges in MFA Adoption

In spite of its benefits, there are challenges associated with the implementation of MFA. Older banking systems usually fail to add new authentication systems. Also, there are those users who do not welcome new levels of security, especially in areas where digital illiteracy is high.

The banks have to deal with these challenges by:

- Clear user education

- Intuitive interface design

- Gradual rollout strategies

- Authentication flows optimization based on analytics

The Future of MFA in Banking

Passwordless authentication is the future of MFA. Traditional passwords will be phased out in favor of biometrics, behavioral analytics and AI-driven risk assessment. Banking applications will be based on invisible security layers that will authenticate the users without involving explicit actions.

Since the development of open banking ecosystems and the growth of the number of third-party integrations, MFA will be a significant component of securing APIs and cross-platform financial services.

A forecast finds the MFA market at USD 21.11 billion in 2025, rising to USD 45.30 billion by 2030 at a ~16.5% CAGR, highlighting strong uptake in enterprise and cloud-focused environments.

Final Thoughts

The application of Multi-Factor Authentication in banking applications is ceasing to be a competitive edge, but a requirement. MFA secures valuable financial information, mitigates fraud, enhances regulatory adherence and boosts customer trust. Banks that invest in strong authentication systems today are setting up for a more secure and sturdy digital tomorrow.

The forward-thinking firms such as 8ration, and other such technology partners have remained to assist financial institutions in the design and development of secure, scalable and easy-to-use banking applications in line with the emerging, emerging security standards and customer expectations.